Crypto to Cash Services in Canada Enable Untraceable Money Laundering

CoinLaw

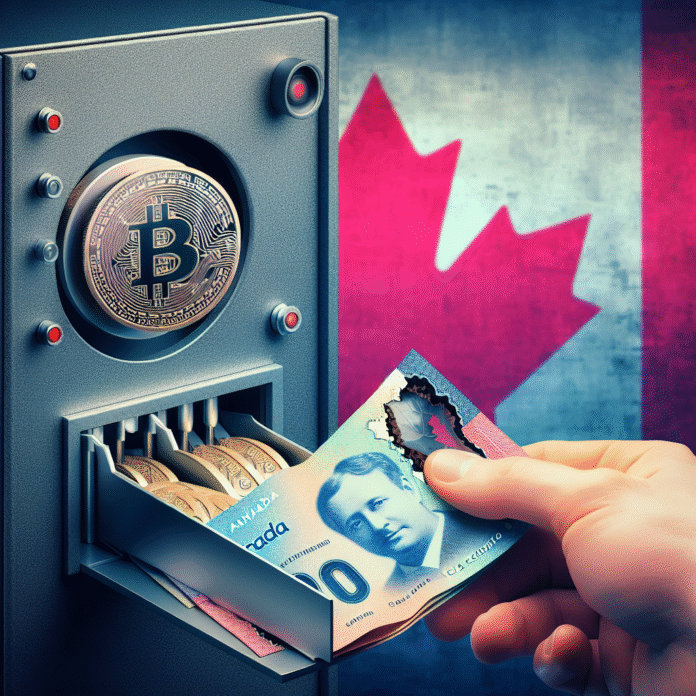

Crypto-to-Cash Services in Canada Enable Untraceable Money Laundering

Recent developments in cryptocurrency regulations have raised concerns about the potential for crypto-to-cash services in Canada to facilitate untraceable money laundering. As the popularity of digital currencies continues to rise, so too does the sophistication of methods used by individuals seeking to exploit these systems for illicit purposes.

The Rise of Crypto-to-Cash Services

Crypto-to-cash services allow users to convert their digital assets into fiat currency, often through ATMs or online platforms. While these services provide a convenient means for legitimate users to access cash, they can also serve as a loophole for criminals looking to launder money. In Canada, the number of Bitcoin ATMs has surged, providing easy access to cash without the stringent identification requirements typically associated with traditional banking.

Weak Regulatory Framework

One of the primary challenges in combating money laundering via crypto-to-cash services is the regulatory framework governing cryptocurrencies in Canada. Although the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has implemented measures to monitor and regulate virtual currencies, many operators of crypto-to-cash services still operate outside the purview of these regulations. This creates an environment where anonymity can thrive, allowing illicit activities to go unchecked.

Methods of Money Laundering

Criminals often use several tactics to exploit crypto-to-cash services for money laundering. One common method involves the use of mixing services, which obfuscate the origins of cryptocurrency by blending funds from multiple users. This process makes it challenging for law enforcement to trace the flow of money. Additionally, individuals may use multiple accounts or wallets to further obscure the source of their funds.

Impact on Law Enforcement

The rise of unregulated crypto-to-cash services poses significant challenges for law enforcement agencies in Canada. With the ability to conduct transactions without revealing identity, criminals can easily move illicit funds across borders. This complicates investigations and increases the burden on authorities tasked with tracking down money laundering activities.

Potential Solutions

To combat the risks associated with crypto-to-cash services, several measures can be considered. Strengthening regulations to ensure that all crypto-to-cash operators adhere to anti-money laundering (AML) guidelines is crucial. Implementing Know Your Customer (KYC) protocols can help mitigate the anonymity that these services currently offer.

Additionally, enhancing collaboration between cryptocurrency exchanges, financial institutions, and law enforcement can improve the sharing of information and resources needed to track suspicious activities. Public awareness campaigns may also play a vital role in educating users about the risks associated with unregulated crypto transactions.

Conclusion

As the landscape of cryptocurrency continues to evolve, so too does the need for comprehensive regulatory frameworks that address the potential for abuse. While crypto-to-cash services offer convenience and accessibility, they also present significant challenges in the fight against money laundering. By implementing stricter regulations and fostering collaboration between stakeholders, Canada can better protect its financial system from exploitation by those seeking to launder money through these digital channels.