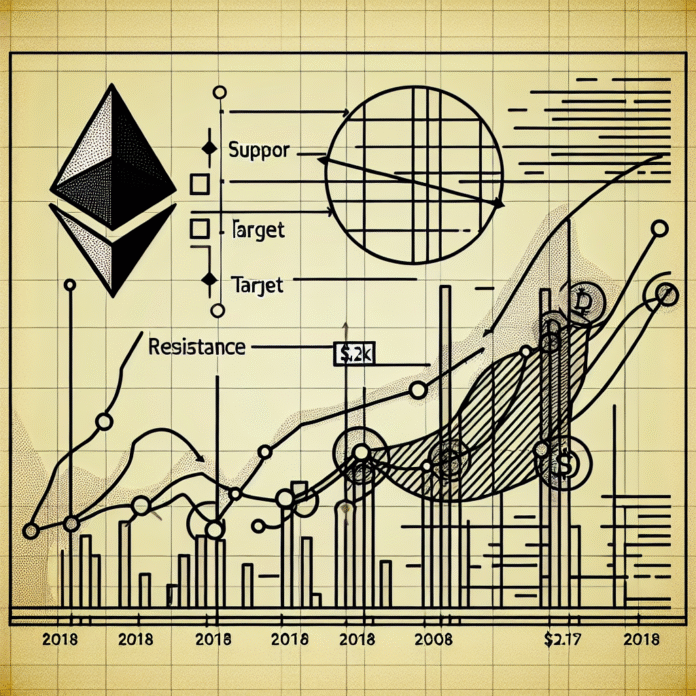

Ethereum Holds $2.3K Support Zone Eyes $2.7K Resistance

Ethereum Holds $2.3K Support Zone, Eyes $2.7K Resistance

Ethereum has recently established a solid support zone around the $2,300 mark, creating a foundation for potential upward movement. As the second-largest cryptocurrency by market capitalization, ETH has become a focal point for traders and investors alike, especially as it navigates through a volatile market landscape.

Current Market Dynamics

Despite facing some challenges in the broader cryptocurrency market, Ethereum’s resilience at the $2,300 support level has sparked optimism. Analysts are closely watching this zone, as a sustained hold could pave the way for a bullish trend. The next significant resistance target is set at $2,700, which, if breached, could signal a renewed bullish momentum.

Factors Influencing Ethereum’s Price

Several factors contribute to Ethereum’s price movements. The ongoing development of the Ethereum 2.0 upgrade, aimed at transitioning the network from a proof-of-work to a proof-of-stake consensus mechanism, continues to generate interest. This upgrade is expected to enhance scalability, security, and energy efficiency, potentially attracting more investors to the platform.

Additionally, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) on the Ethereum blockchain has further solidified its position in the market. As more projects are built on Ethereum, demand for the cryptocurrency may increase, supporting its price.

Market Sentiment and Future Outlook

Market sentiment remains a crucial factor for Ethereum and the broader cryptocurrency market. Positive news, such as institutional adoption and regulatory clarity, could drive prices higher. Conversely, negative developments, such as regulatory crackdowns or market corrections, may pose challenges.

Investors should remain cautious and conduct thorough research, as the cryptocurrency market can be highly unpredictable. Overall, while Ethereum currently holds a critical support level, the path forward will depend on various external factors and the overall market environment.

In conclusion, Ethereum’s ability to maintain the $2,300 support zone while eyeing the $2,700 resistance is pivotal for its future price action. As developments unfold, both short-term traders and long-term investors will be keenly observing these key levels.