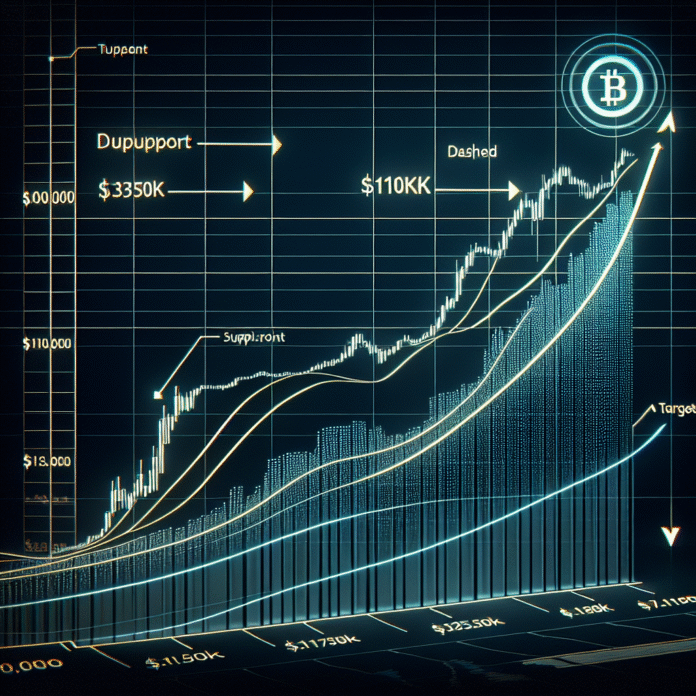

Bitcoin Price Prediction for BTC-USD Targets $135K Following $110K Stabilization

Bitcoin Price Outlook: BTC-USD Targets $135,000 After Sustaining $110,000 Support

As the cryptocurrency market continues to evolve, Bitcoin (BTC) remains a focal point for investors and analysts alike. Recent trends indicate that Bitcoin is not just holding its ground but is positioning itself for a significant upward movement. After successfully maintaining support around the $110,000 mark, many experts are now eyeing a potential surge towards $135,000.

Market Resilience and Investor Sentiment

Bitcoin’s ability to hold the $110,000 level demonstrates its resilience in an ever-changing market. After experiencing fluctuations due to regulatory news and macroeconomic factors, the cryptocurrency community is gaining confidence. Increased institutional interest and the growing acceptance of Bitcoin as a legitimate asset class have contributed to this optimistic sentiment.

Furthermore, as more companies and individuals recognize Bitcoin’s potential as a hedge against inflation, demand is expected to rise. The recent uptick in Bitcoin’s price can also be attributed to a wave of new investors entering the market, drawn by the allure of digital assets.

Technical Analysis and Predictions

Technical analysis suggests that Bitcoin could be primed for a breakout. Analysts are observing key resistance levels that, if surpassed, could facilitate a rapid ascent toward $135,000. The current price action indicates bullish momentum, with many traders looking for confirmation of upward trends through various indicators such as moving averages and relative strength index (RSI).

Moreover, the upcoming Bitcoin halving event, expected to occur in 2024, has historically been a catalyst for price surges. This event, which reduces the reward for mining new blocks, often leads to a decrease in supply while demand remains constant or increases, driving prices higher.

Factors Influencing Bitcoin’s Price Movement

Several factors could influence Bitcoin’s trajectory in the coming months. Regulatory advancements, such as clearer guidelines from governments around the world, could either bolster or hinder Bitcoin’s growth. Additionally, macroeconomic conditions, including inflation rates and central bank policies, will play a crucial role in shaping market dynamics.

The ongoing developments in decentralized finance (DeFi) and non-fungible tokens (NFTs) also contribute to the broader cryptocurrency landscape, potentially impacting Bitcoin’s value. As Bitcoin continues to solidify its position as a digital gold, its correlation with traditional markets will also be an essential factor to watch.

Conclusion

In summary, Bitcoin’s recent stability at the $110,000 level sets the stage for a potential rally towards $135,000. With positive investor sentiment, favorable technical indicators, and upcoming events on the horizon, the cryptocurrency may be poised for significant growth. However, investors should remain vigilant, considering the myriad of factors that could influence Bitcoin’s price in the ever-evolving cryptocurrency marketplace. As always, thorough research and risk management are essential for navigating this volatile asset class.