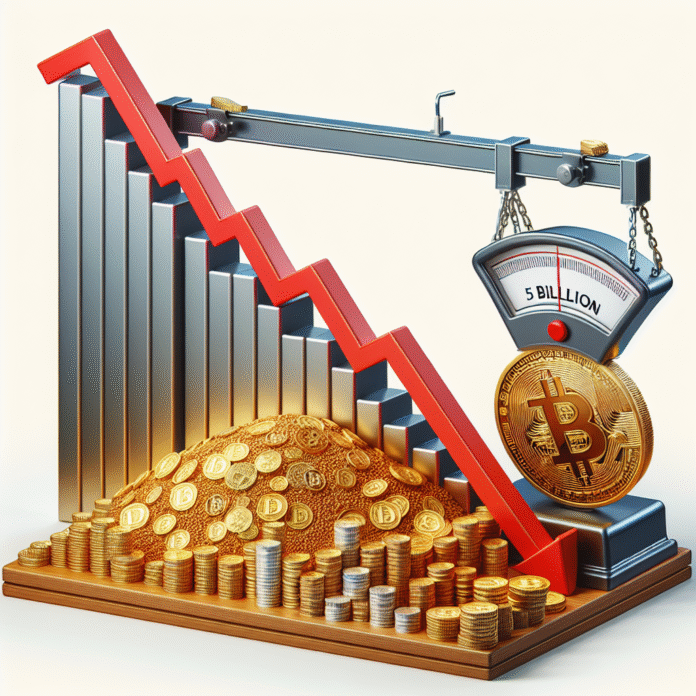

Bitcoin Price Experiences New Pressure as Miner Deposits to Binance Exceed $5 Billion

Bitcoin Price Faces New Pressure as Miner Deposits to Binance Surpass $5 Billion

As Bitcoin continues to navigate a volatile market, recent developments indicate that miner deposits to the Binance exchange have exceeded $5 billion. This influx of Bitcoin from miners is raising concerns about potential downward pressure on the cryptocurrency’s price.

Understanding Miner Deposits

Miner deposits typically refer to the Bitcoin that miners send to exchanges for sale or trading. When a significant amount of Bitcoin is deposited into platforms like Binance, it can signal that miners are looking to liquidate their holdings, possibly due to declining profitability or market conditions. This large-scale selling can lead to increased supply in the market, which often results in downward pressure on prices.

Market Reactions and Implications

The recent surge in miner deposits has sparked reactions among traders and analysts. Many are closely monitoring Bitcoin’s price movements, as a consistent trend of increased deposits could indicate a bearish sentiment among miners. Additionally, the psychological impact of such movements can affect retail investors’ confidence, leading to further sell-offs.

In contrast, some analysts argue that these deposits could also be part of a strategic move by miners to capitalize on short-term price fluctuations. Miners may be taking advantage of temporary spikes in Bitcoin’s value to secure profits before potential corrections.

Broader Market Context

Bitcoin’s price behavior cannot be viewed in isolation. It is influenced by a myriad of factors, including macroeconomic trends, regulatory developments, and investor sentiment. As of now, the cryptocurrency market remains sensitive to news related to interest rates, inflation, and global economic stability.

Moreover, the overall performance of the crypto market, including the actions of large institutional investors and trends in alternative cryptocurrencies, can also play a significant role in shaping Bitcoin’s trajectory.

Future Outlook

Looking ahead, the situation remains fluid. Analysts suggest that while the influx of miner deposits to exchanges like Binance is a critical indicator, it is essential to consider broader market dynamics. As Bitcoin continues to evolve, understanding the motivations behind miner behavior and their impact on the market will be crucial for traders and investors alike.

In conclusion, while the rise in miner deposits to Binance signals potential challenges for Bitcoin’s price in the short term, ongoing developments in the broader market will ultimately determine the cryptocurrency’s future direction. Investors are urged to stay informed and consider various factors before making trading decisions.