Amid Tariff Chaos the US Just Passed Its First Crypto Law Unnoticed

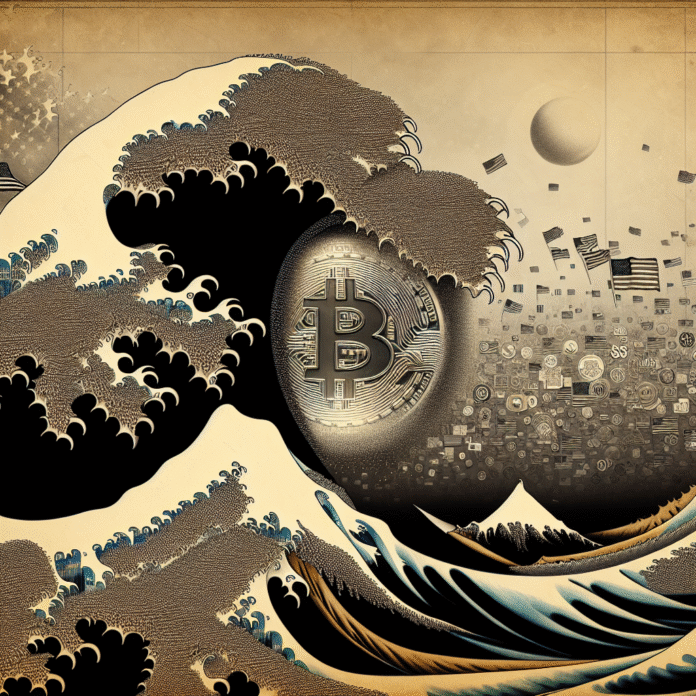

Amid Tariff Chaos, the US Passes Its First Crypto Law Unnoticed

In a surprising turn of events, the United States has recently enacted its first comprehensive cryptocurrency legislation, largely flying under the radar amidst ongoing tariff disputes and economic uncertainties. This new law represents a significant shift in the regulatory landscape for digital currencies, providing clarity and guidance for businesses and investors involved in the crypto space.

Understanding the New Legislation

The newly passed law aims to establish a regulatory framework that addresses various aspects of cryptocurrency, including taxation, consumer protection, and anti-money laundering measures. By defining key terms and concepts, the legislation eliminates much of the ambiguity that has previously clouded the cryptocurrency market. This clarity is expected to foster innovation and attract more participants to the sector.

Key Provisions of the Law

Some of the notable provisions include:

1. **Tax Regulations**: The law clarifies how cryptocurrencies will be treated for tax purposes, ensuring that individuals and businesses understand their obligations when trading or holding digital assets.

2. **Consumer Protections**: New measures have been introduced to protect consumers from fraud and scams, requiring companies to adhere to stricter guidelines when marketing and selling crypto-related products.

3. **AML Compliance**: The law mandates that cryptocurrency exchanges and wallets implement robust anti-money laundering (AML) compliance protocols, aligning them more closely with traditional financial institutions.

4. **Licensing Requirements**: Cryptocurrency businesses may now be required to obtain licenses at both state and federal levels, which will help regulate the market and ensure that operators meet certain standards.

The Impact on the Crypto Market

The passage of this law may lead to increased legitimacy for cryptocurrencies, attracting institutional investors who have been hesitant due to the uncertain regulatory environment. With clearer rules in place, companies may feel more secure in developing blockchain technologies and launching new digital assets.

Moreover, increased regulatory oversight could result in a more stable market, potentially reducing the volatility that has characterized cryptocurrencies in the past. However, some advocates worry that excessive regulation could stifle innovation and push businesses to operate in less regulated jurisdictions.

Broader Economic Context

The timing of this legislation is particularly intriguing given the ongoing tariff chaos affecting various sectors of the economy. As trade tensions continue to rise, the introduction of clear crypto regulations could serve as a counterbalance, providing a fresh avenue for economic growth. As businesses seek new opportunities amid trade disruptions, the burgeoning cryptocurrency market may offer a viable alternative for investment and expansion.

Conclusion

While the new cryptocurrency law may have gone largely unnoticed amid other pressing economic issues, its implications for the digital asset landscape are profound. As the US government takes steps to regulate this rapidly evolving market, stakeholders must remain vigilant, adapting to new compliance requirements and seizing opportunities that arise in this dynamic environment. The future of cryptocurrency in the United States may be more secure and structured than ever before, paving the way for greater acceptance and integration into the broader financial ecosystem.