Americans Losing Millions to Scammers at Crypto ATMs

How Companies Profit

CNN

Americans are Losing Millions to Scammers at Crypto ATMs

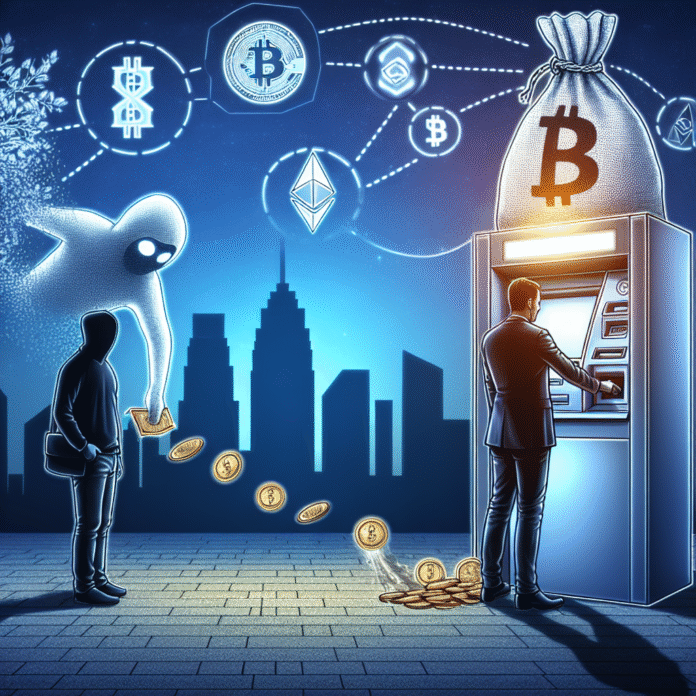

In recent years, the rise of cryptocurrency has led to the proliferation of crypto ATMs across the United States. However, alongside this growth, a troubling trend has emerged: Americans are losing millions of dollars to scammers exploiting these machines. As these ATMs become more prevalent, it is crucial for users to understand the risks and the ways in which companies are profiting from this situation.

The Mechanics of Crypto ATMs

Crypto ATMs allow users to buy and sell cryptocurrencies, such as Bitcoin, using cash or debit cards. Unlike traditional ATMs, these machines do not require a bank account, making them accessible to a broader audience. While this convenience has attracted many users, it has also caught the attention of scammers who exploit the lack of regulation and oversight in this relatively new market.

Scammers Target Vulnerable Individuals

Scammers often use social engineering tactics to deceive victims into using crypto ATMs. They might pose as tech support or law enforcement officials, claiming that the individual needs to pay a fine or settle a debt immediately using cryptocurrency. Victims, often overwhelmed and confused, may not fully understand the transaction, leading them to withdraw cash and make a purchase at a nearby crypto ATM. In many cases, once the transaction is completed, it becomes nearly impossible to recover the lost funds.

How Companies Profit from Crypto ATMs

Companies that operate crypto ATMs typically charge fees for transactions, which can range from 7% to 20%, significantly higher than traditional ATM fees. While these fees are disclosed, many users may not realize how much they are paying until after the transaction is completed. Additionally, the lack of regulation means that companies are not required to implement robust security measures or provide adequate consumer education, allowing scammers to thrive. The profit margins for these companies can be substantial, raising ethical concerns regarding their responsibility in preventing fraudulent activity.

Rising Concerns and Regulatory Responses

As reports of scams continue to rise, regulatory bodies are beginning to take notice. Some states are implementing stricter regulations on crypto ATM operators, requiring them to register with financial authorities and adhere to anti-money laundering laws. These measures aim to increase accountability and protect consumers from scams. However, the pace of regulation has been slow, and many operators continue to operate with minimal oversight.

Protecting Yourself Against Crypto ATM Scams

To safeguard against potential scams, consumers should educate themselves about cryptocurrency and the workings of crypto ATMs. Here are some tips to consider:

- Always verify the identity of anyone requesting payment in cryptocurrency.

- Be cautious of unsolicited phone calls or messages claiming to be from government agencies or technical support.

- Research the fees associated with crypto ATMs before making a transaction.

- If a deal seems too good to be true, it probably is—trust your instincts.

Conclusion

The rise of crypto ATMs has provided a new avenue for consumers to engage with digital currencies, but it has also opened the door to scams and fraud. As the industry continues to evolve, both consumers and operators must prioritize security and transparency to mitigate risks. By remaining informed and vigilant, individuals can protect themselves from falling victim to these schemes while enjoying the benefits of cryptocurrency.