Cryptocurrency Status in Limbo as Officials Fear Dollarization of Economy and Unclear Global Regulation

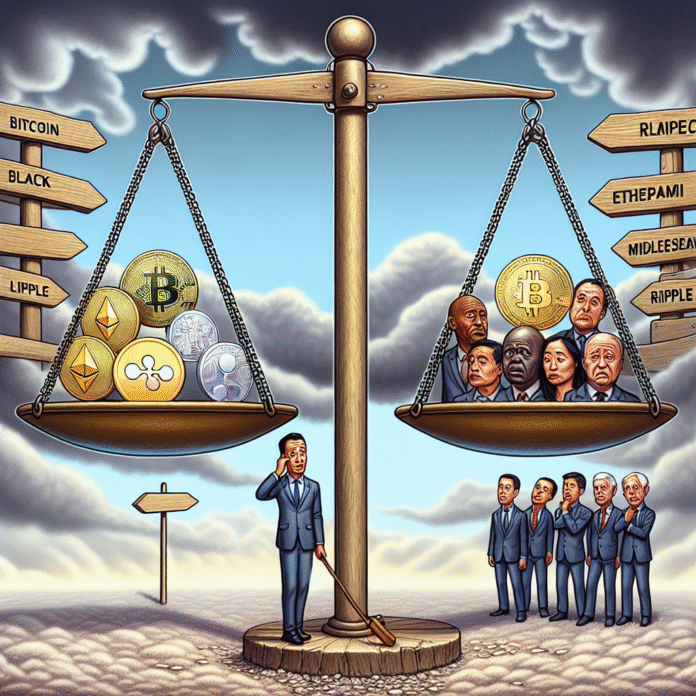

Cryptocurrency Status in Limbo as Officials Fear ‘Dollarization’ of Economy and Unclear Global Regulation

The status of cryptocurrency continues to hang in the balance as government officials express concerns over the potential ‘dollarization’ of the economy. This phenomenon refers to the increasing reliance on foreign currencies, particularly the U.S. dollar, which could undermine national monetary sovereignty. As cryptocurrencies gain traction in various markets, the implications for economic stability and regulatory frameworks have become a focal point for governments worldwide.

Concerns Over Economic Sovereignty

Officials are increasingly worried that the adoption of cryptocurrencies could lead to a scenario where local economies become overly dependent on digital assets, diminishing the role of national currencies. This could result in diminished control over monetary policy, affecting inflation rates and economic growth. Central banks are scrutinizing the rise of cryptocurrencies, as they are perceived as a threat to traditional financial systems that rely heavily on the stability of a national currency.

The Global Regulatory Landscape

Compounding these concerns is the lack of a clear global regulatory framework for cryptocurrencies. Different countries are approaching the regulation of digital assets in vastly different ways. While some nations have embraced cryptocurrencies and blockchain technology, others have implemented strict bans or regulatory hurdles. This fragmented approach creates uncertainty for investors and businesses operating in the cryptocurrency space.

The Role of Stablecoins

Stablecoins, which are pegged to traditional currencies like the U.S. dollar, are gaining popularity as a means to mitigate volatility in the cryptocurrency market. However, their rise also raises questions about regulatory oversight and potential risks to financial stability. As stablecoins become more integrated into the financial system, regulators are tasked with ensuring that they do not contribute to the ‘dollarization’ trend that many fear.

International Collaboration and Future Outlook

To address these challenges, international collaboration among regulators is essential. Organizations like the Financial Stability Board (FSB) and the International Monetary Fund (IMF) are working towards establishing guidelines that can help unify the regulatory approach to cryptocurrencies globally. This could pave the way for a more stable environment for digital assets, balancing innovation with the need for consumer protection and economic stability.

As the cryptocurrency landscape continues to evolve, market participants, regulators, and governments will need to navigate these complex dynamics carefully. The ongoing dialogue about the implications of cryptocurrencies on economic sovereignty and the need for cohesive regulation will shape the future of digital currencies and their role in the global economy.