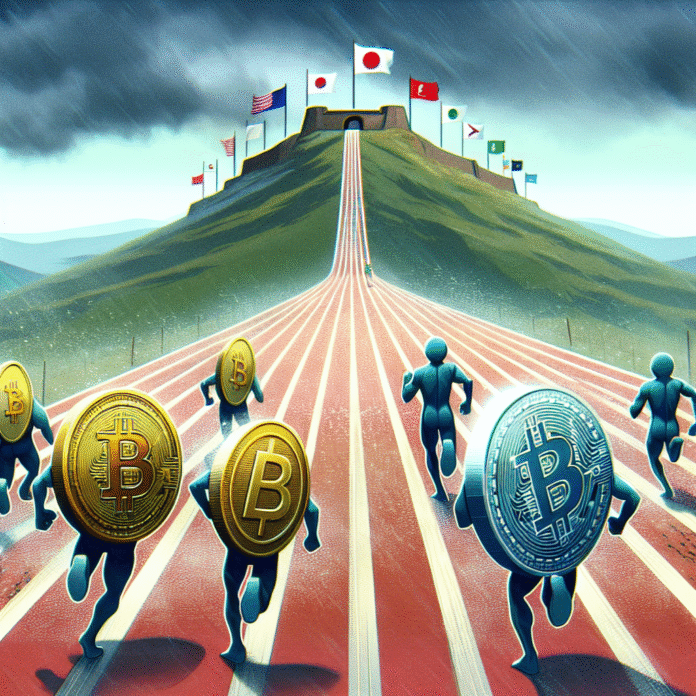

Crypto’s Upcoming Rally Paused as Bank of Japan and Federal Reserve Maintain Hawkish Stance for December Forecast

Crypto Market Faces Uncertainty Amid Hawkish Central Bank Stance

As we approach the end of the year, the cryptocurrency market is experiencing a pause in its anticipated rally. This stagnation is largely attributed to the recent hawkish outlooks from major central banks, particularly the Bank of Japan (BoJ) and the U.S. Federal Reserve. Investors are closely monitoring these developments, which are expected to have significant implications for both traditional and digital assets.

Impact of Central Bank Policies on Cryptocurrency

The Federal Reserve has maintained a firm stance on interest rates, signaling that further hikes may be needed to combat inflation. This approach has created a ripple effect across financial markets, with riskier assets, including cryptocurrencies, facing increased pressure. The BoJ, while historically known for its accommodative monetary policy, has also hinted at a possible shift towards tightening, further contributing to the cautious sentiment among investors.

Market Reactions and Investor Sentiment

In light of these central bank policies, cryptocurrency prices have shown signs of volatility. Traders are grappling with uncertainty, and many are adopting a wait-and-see approach. Bitcoin, the leading cryptocurrency, has struggled to break past key resistance levels, while altcoins have similarly faced headwinds. The bearish sentiment has led to a decline in trading volumes and has deterred new investors from entering the market.

Potential for Future Growth

Despite the current challenges, there are still reasons for optimism within the crypto space. Technological advancements, regulatory clarity in various jurisdictions, and increasing institutional adoption continue to lay the groundwork for long-term growth. Furthermore, as central banks eventually pivot towards more accommodative policies, the market could see a resurgence in interest, potentially catalyzing the next rally.

Conclusion

In conclusion, while the cryptocurrency market is currently on hold due to the hawkish stances of the Bank of Japan and the Federal Reserve, the long-term outlook remains promising. Investors should remain vigilant and consider the broader economic context as they navigate this dynamic landscape. As central banks adapt their policies in response to evolving economic conditions, the crypto market may soon find itself in a position to rally once more.