Germany’s Sparkassen to Launch Bitcoin BTC and Ether ETH Trading

UK Plans Stricter Crypto Rules for Banks

Blockchain News

Germany’s Sparkassen to Launch Bitcoin (BTC) & Ether (ETH) Trading

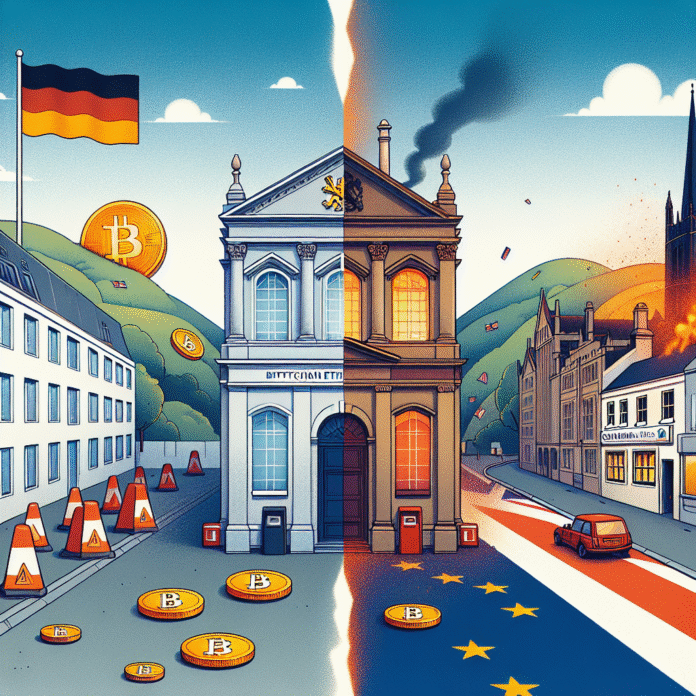

In a significant development for the cryptocurrency landscape, Germany’s Sparkassen, a network of public savings banks, has announced plans to introduce trading for Bitcoin (BTC) and Ether (ETH). This move marks a pivotal step toward integrating cryptocurrencies into mainstream finance, offering customers the opportunity to engage with digital assets through a trusted banking institution.

The initiative is part of Sparkassen’s broader strategy to adapt to the evolving financial landscape, where demand for cryptocurrency services is surging among retail investors. By enabling trading in major cryptocurrencies, Sparkassen aims to provide a secure and user-friendly platform for its clientele, ensuring that they can access digital currencies with the backing of a reputable banking network.

UK’s Stricter Crypto Regulations for Banks

As Germany embraces cryptocurrency trading, the UK is moving in the opposite direction, proposing stricter regulations for banks involved in cryptocurrency transactions. The Financial Conduct Authority (FCA) is considering implementing more rigorous compliance requirements aimed at safeguarding consumers and enhancing the integrity of the financial system. These potential rules come in response to the increasing concerns over the volatility of cryptocurrencies and their potential use in illegal activities, such as money laundering and fraud.

The UK government’s approach reflects a growing trend among regulators worldwide to impose more stringent oversight of the cryptocurrency sector. This regulation aims to ensure that banks and financial institutions maintain high standards of risk management and consumer protection when dealing with digital assets.

The Global Crypto Landscape

As countries navigate the complexities of cryptocurrency regulation, the global landscape continues to evolve rapidly. In addition to Germany and the UK, other nations are also exploring frameworks to either embrace or restrict the use of cryptocurrencies. For instance, countries like El Salvador have adopted Bitcoin as legal tender, while China has cracked down on cryptocurrency trading and mining activities.

The disparity in regulatory approaches highlights the need for a coherent international framework that can address the challenges posed by cryptocurrencies while fostering innovation. As the market matures, collaboration between governments, financial institutions, and the cryptocurrency industry may pave the way for a balanced approach that protects consumers without stifling technological advancement.

In conclusion, the launch of Bitcoin and Ether trading by Germany’s Sparkassen represents a significant shift toward the mainstream adoption of cryptocurrencies. Meanwhile, the UK’s consideration of stricter regulations underscores the ongoing dialogue surrounding the safe integration of digital assets into the traditional financial system. As these developments unfold, they will likely influence how cryptocurrencies are perceived and utilized globally.