Gold Shines Bright as Safe-Haven Demand Surpasses Strong US Payrolls Amid Global Unease

Gold Shines Bright: Safe-Haven Demand Outweighs Strong US Payrolls Amidst Global Unease

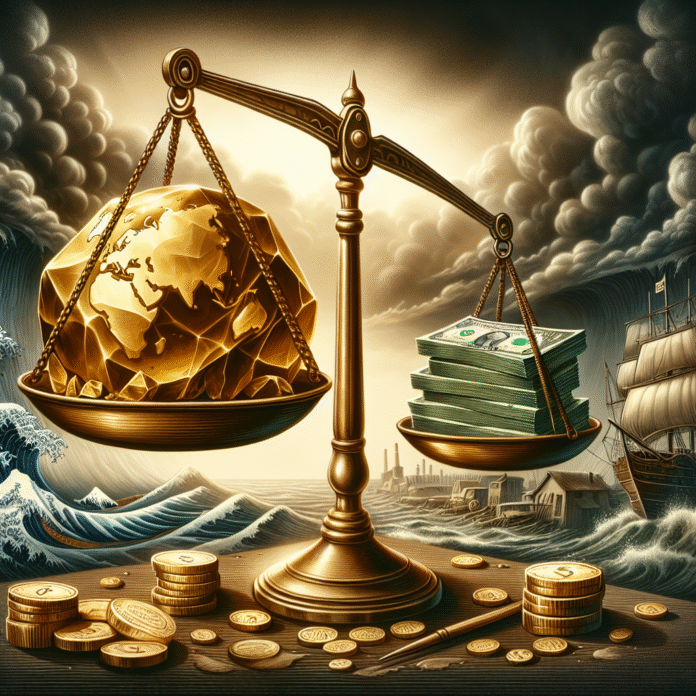

FinancialContent – In the current economic landscape, gold is maintaining its allure as a safe-haven asset, even in the face of robust US payroll figures. Recent reports indicate that despite a significant increase in job creation across the nation, investor sentiment is largely focused on safeguarding their assets against global uncertainties.

Strong US Payrolls and Market Reaction

The latest employment data revealed that the US economy added a substantial number of jobs last month, exceeding analysts’ expectations. This positive news typically bolsters confidence in the economy and strengthens the US dollar. However, the reaction in the gold market tells a different story. Instead of declining, gold prices have remained resilient, highlighting a shift in market sentiment.

Investors are increasingly concerned about geopolitical tensions, inflationary pressures, and potential economic slowdowns in various regions, including Europe and Asia. These factors are driving demand for gold as a reliable store of value, even when other economic indicators seem positive.

Global Economic Concerns

The ongoing global unease is fueled by a variety of factors, including rising energy prices, supply chain disruptions, and the potential for interest rate hikes by central banks. As central banks navigate the delicate balance between controlling inflation and supporting economic growth, investors are wary of future market volatility.

Moreover, recent geopolitical events—such as tensions in Eastern Europe and trade disputes—have further exacerbated fears of instability. In such times, gold often shines as a beacon of safety, drawing both institutional and retail investors seeking to protect their portfolios.

The Role of Inflation and Interest Rates

Inflation remains a top concern for investors. As prices continue to rise, the purchasing power of cash diminishes, prompting many to turn to tangible assets like gold. Historically, gold has been viewed as a hedge against inflation, making it an attractive choice in uncertain economic environments.

Additionally, with the likelihood of interest rate changes looming on the horizon, investors are closely monitoring central bank policies. Higher interest rates can diminish the appeal of non-yielding assets like gold, but if inflation persists, the demand for gold may continue to outweigh potential downward pressures from interest rate hikes.

Looking Ahead

As we move forward, the outlook for gold remains cautiously optimistic. While strong economic indicators such as job growth can provide a short-term boost to market confidence, the underlying concerns surrounding inflation, geopolitical tensions, and economic instability suggest that gold will continue to be a favored investment for those seeking security.

Investors are advised to stay informed and consider diversifying their portfolios to include gold, not only as a hedge against inflation but also as a safeguard against unpredictable global events. As history has shown, gold often emerges as a pillar of strength during turbulent times, and its shine is unlikely to dim anytime soon.