Considering Bitcoin for Your 401(k) May Be Risky

Insights from Bloomberg

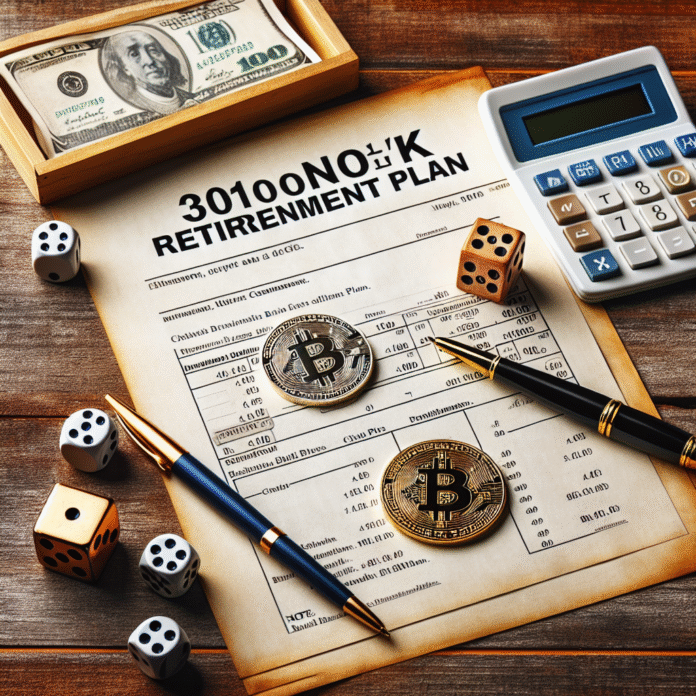

Considering Bitcoin in Your 401(k): A Risky Proposition

The rapid rise of Bitcoin and other cryptocurrencies has sparked significant interest among investors, especially those looking to diversify their retirement portfolios. However, integrating Bitcoin into a 401(k) plan is a move that many financial experts caution against.

The Volatility of Cryptocurrencies

One of the primary concerns regarding Bitcoin’s inclusion in retirement accounts is its notorious volatility. Unlike traditional assets such as stocks or bonds, cryptocurrencies can experience dramatic price fluctuations within a short time frame. For instance, Bitcoin has seen its value soar to new heights, only to plummet significantly in a matter of days or weeks. This unpredictability poses a substantial risk for retirement savings, which ideally should be more stable and less prone to market whims.

Regulatory and Security Concerns

Another significant issue is the evolving regulatory landscape surrounding cryptocurrencies. Governments and financial institutions are still grappling with how to handle digital currencies, which could lead to sudden regulatory changes that might affect their value and legality. Additionally, the security of cryptocurrency investments is a concern. Hacks and cyberattacks on exchanges have resulted in substantial losses for investors, highlighting the need for robust security measures.

Limited Historical Performance Data

While Bitcoin has garnered attention for its impressive returns over the past decade, it is essential to consider that it does not have a long track record compared to traditional investments. This lack of historical performance data makes it challenging for investors to gauge the long-term viability of Bitcoin as a retirement asset. Investments in a 401(k) should typically be based on historical performance and market stability, which cryptocurrencies currently lack.

The Impact on Retirement Planning

Incorporating Bitcoin into a 401(k) could lead to a misallocation of assets. Diversification is crucial for retirement planning; however, a heavy reliance on a volatile asset like Bitcoin could jeopardize financial security in retirement. Individuals nearing retirement age may find it particularly risky to invest in high-volatility assets, as they have less time to recover from potential losses.

Alternatives to Bitcoin in Retirement Accounts

For those looking to add some exposure to the cryptocurrency market, there are safer alternatives. Some financial institutions offer cryptocurrency-related investment funds that blend traditional assets with a smaller allocation to cryptocurrencies. This approach allows investors to gain some exposure to the digital currency market without fully committing their retirement savings to a highly speculative asset.

Conclusion

While the allure of Bitcoin may be tempting, incorporating it into your 401(k) is fraught with risks that could undermine your long-term financial goals. It is crucial to weigh the potential rewards against the inherent volatility and uncertainties of cryptocurrencies. For most investors, a more balanced and diversified approach to retirement savings that prioritizes stability and security is advisable. Always consult with a financial advisor to assess your individual risk tolerance and develop a strategy that aligns with your retirement objectives.