Crypto Market Eyes Senate Cloture Vote Key Implications for Regulation and Trading

Analysis by Paul Grewal Blockchain News

“`html

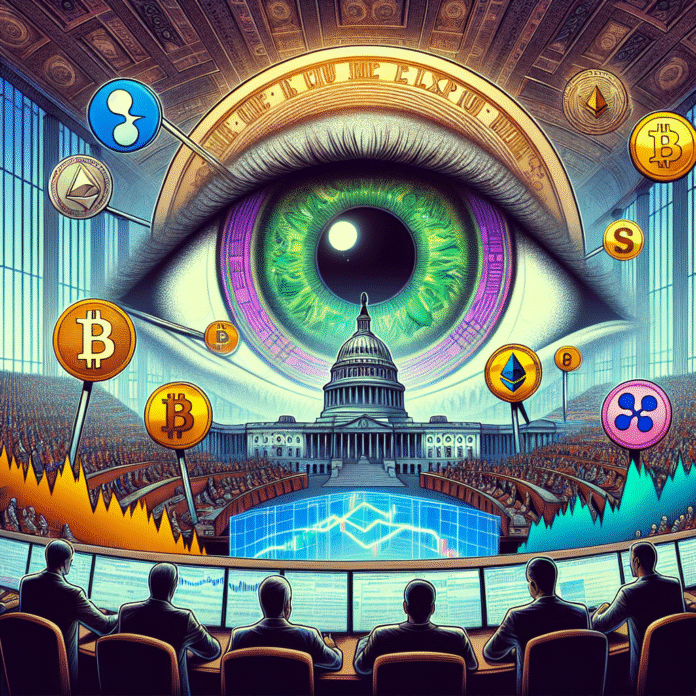

Crypto Market Eyes Senate Cloture Vote: Key Implications for Regulation and Trading

By Paul Grewal, Blockchain News

The cryptocurrency market is bracing for significant developments as the U.S. Senate prepares for a crucial cloture vote that could shape the future of digital asset regulation. This vote is not just a procedural step; it has the potential to impact trading practices, investor confidence, and the overall landscape of the cryptocurrency ecosystem.

Understanding the Cloture Vote

A cloture vote in the Senate is a mechanism used to end filibusters and bring a bill to the floor for a final vote. In the context of cryptocurrency, this vote will determine whether proposed regulations aimed at the digital asset market will advance for further debate and eventual approval. Given the rapid evolution of the crypto space, timely regulations are essential to ensure consumer protection and market integrity.

Implications for Regulation

The outcome of the cloture vote could pave the way for comprehensive regulatory frameworks that govern how cryptocurrencies are traded and managed. If the Senate moves forward with favorable legislation, we may see clearer guidelines regarding the classification of digital assets, taxation policies, and compliance requirements for cryptocurrency exchanges. This clarity will be crucial for institutional investors, who have been hesitant to enter the market due to regulatory uncertainties.

Impact on Trading Practices

A positive outcome from the cloture vote could also lead to enhanced trading practices in the cryptocurrency market. With regulations in place, exchanges may adopt more robust security measures, leading to increased consumer trust. Furthermore, regulatory clarity could encourage traditional financial institutions to engage more actively in cryptocurrency trading, potentially resulting in increased liquidity and market stability.

Investor Confidence

Investor sentiment is heavily influenced by the regulatory environment. A favorable cloture vote can instill confidence among retail and institutional investors alike, potentially driving more capital into the crypto space. Conversely, if the vote does not go as hoped, it could lead to increased volatility and uncertainty, causing investors to reassess their positions.

The Bigger Picture

The Senate’s decision on the cloture vote is just one piece of the broader regulatory puzzle facing the cryptocurrency market. As the global landscape evolves, other countries are also moving towards establishing their own regulatory frameworks. The U.S. must navigate these developments carefully to maintain its position as a global leader in financial innovation.

Conclusion

As the Senate prepares for the cloture vote, all eyes in the cryptocurrency market are focused on the potential implications for regulation and trading practices. The outcome could set the stage for a new era of growth and stability within the digital asset space, or it could hinder progress and lead to further uncertainty. Stakeholders across the industry are closely monitoring the situation, understanding that the decisions made in the coming days will have lasting impacts on the future of cryptocurrency in the United States.

“`