Share of Gold in India’s Forex Reserves Doubles in Four Years as Indicated by Central Bank

Share of Gold in India’s Forex Reserves Doubles in Four Years, Central Bank Report Shows

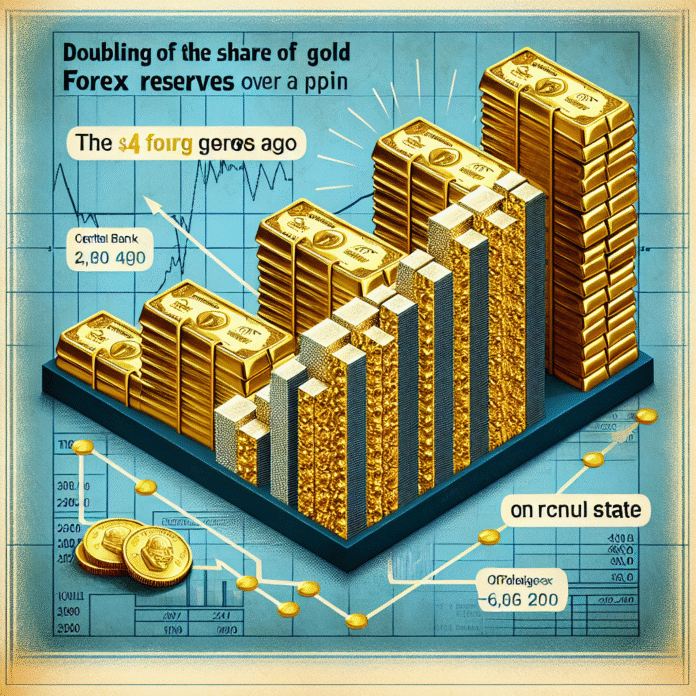

India’s foreign exchange reserves have seen a significant transformation over the past four years, with the share of gold doubling in the overall composition. According to a recent report by the Reserve Bank of India (RBI), gold now constitutes a more substantial part of the country’s forex reserves, reflecting a strategic shift in the management of these assets.

Current Trends in Forex Reserves

As of the latest data, gold accounts for approximately 14% of India’s total foreign exchange reserves, up from around 7% four years ago. This increase highlights a growing trend among central banks worldwide to diversify their reserves away from traditional currencies and into gold, which is often seen as a safer investment during economic uncertainty.

Reasons Behind the Rise in Gold Holdings

Several factors contribute to this rising share of gold in India’s forex reserves:

1. **Economic Stability**: Gold is viewed as a safe haven asset during times of economic instability. With global economic fluctuations, central banks tend to increase their gold holdings to mitigate risks.

2. **Inflation Hedge**: As inflation rates rise, the value of fiat currencies can diminish. Gold historically maintains its value over time and can serve as an effective hedge against inflation.

3. **Geopolitical Factors**: Rising geopolitical tensions and trade disputes have led many countries, including India, to bolster their gold reserves as part of their national security strategy.

Impact on India’s Economy

The doubling of gold’s share in India’s forex reserves has implications for the nation’s economy. A higher gold reserve can strengthen the country’s financial stability and enhance its credit rating. Furthermore, it provides the RBI with greater flexibility in managing the currency and addressing balance of payments issues.

Additionally, with gold prices fluctuating based on global demand, India’s increased holdings may yield significant returns if the market conditions are favorable. The RBI’s strategy of accumulating more gold aligns with a broader trend among emerging economies, where central banks are increasingly recognizing the importance of gold in their financial strategies.

Conclusion

In conclusion, the doubling of gold’s share in India’s forex reserves over the past four years underscores a deliberate and strategic approach by the Reserve Bank of India. As global economic landscapes evolve, India’s focus on enhancing its gold reserves positions the nation to better navigate financial uncertainties while reinforcing its economic resilience. The ongoing commitment to diversifying foreign exchange reserves will likely remain a priority for the RBI in the years to come.